Residual Land Valuation (RLV) is a crucial concept for property developers, investors, and landowners looking to understand the value of a piece of land based on its potential for development. Whether you’re new to property development or an experienced professional, knowing how to calculate and interpret an RLV can make or break a project. In this guide, we’ll break down what residual land valuation is, how it works, and why it’s essential for development site appraisals.

What is Residual Land Valuation?

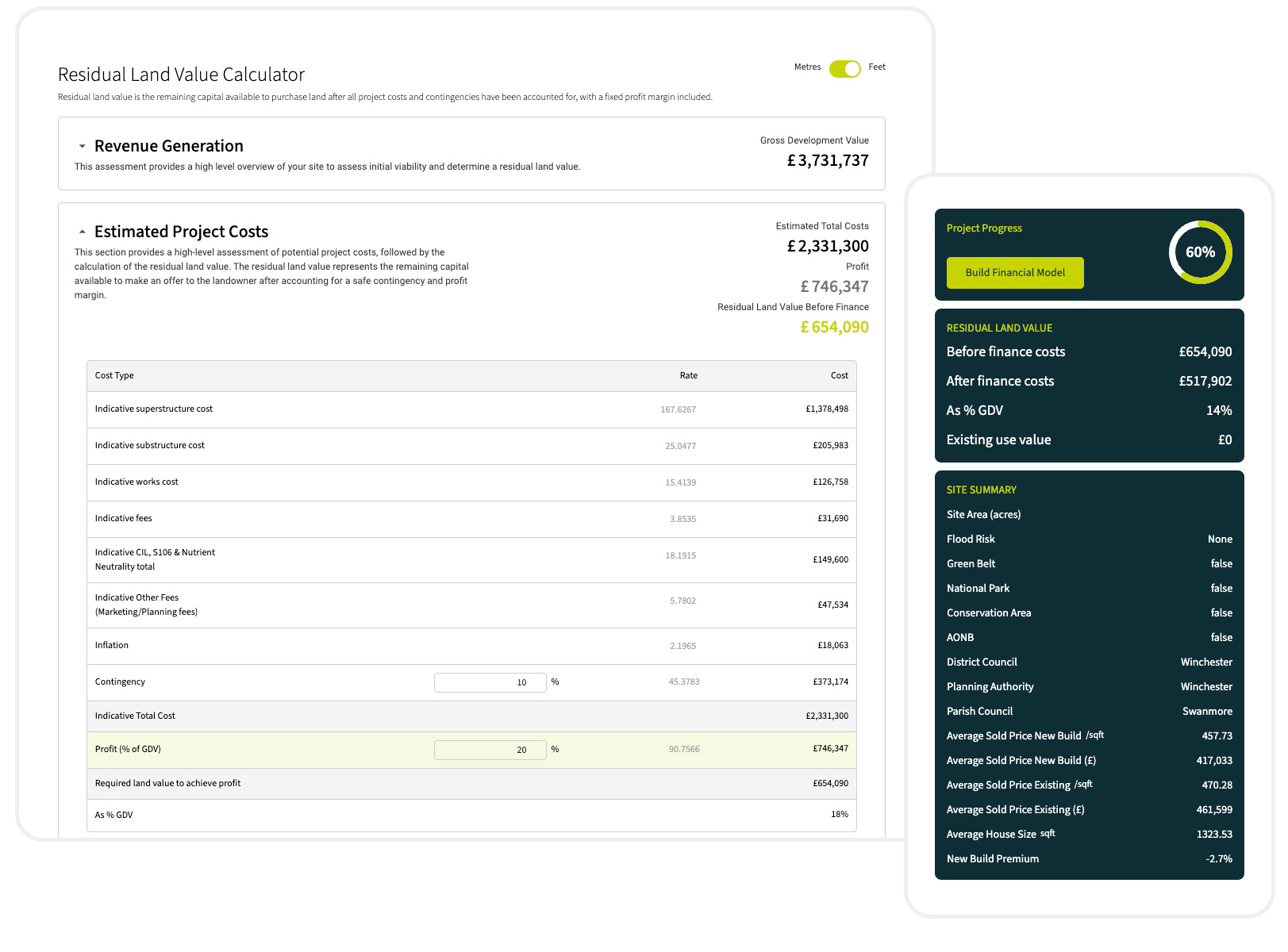

Residual Land Valuation is a method used to determine the value of a piece of land by calculating the difference between the total development value of a project and the combined costs of construction, fees, and developer’s profit. Essentially, it’s a reverse calculation: you start with the estimated value of the completed development (the Gross Development Value or GDV), subtract all associated costs and a predetermined profit margin, and the remainder is the residual land value, the maximum amount you can afford to pay for the land while ensuring profitability.

This method is widely used in property development as it reflects the economic reality of development projects. Furthermore, by focusing on what the land is worth in its highest and best use, RLV provides a realistic benchmark for land acquisition decisions.

How Does Residual Land Valuation Work?

The formula for Residual Land Valuation is straightforward:

Residual Land Value = Gross Development Value (GDV) – Development Costs – Developer’s Profit

Here’s a breakdown of each component:

- Gross Development Value (GDV):

- The estimated market value of the completed development. For example, if you’re building homes, the GDV would be the total sales value of all the units once sold.

- Development Costs:

- This includes all costs associated with the development, such as construction, planning, legal fees, finance costs, contingencies and professional fees.

- Developer’s Profit:

- A fixed percentage of the GDV (commonly 15-20%), representing the return the developer expects for taking on the project risk.

By subtracting the development costs and desired profit from the GDV, you’re left with the residual land value.

An Example of Residual Land Valuation

Let’s say a developer is considering purchasing a site to build 10 houses. The GDV is estimated at £5 million. The development costs are projected to be £3.5 million, and the developer requires a profit margin of 20% of the GDV (£1 million).

- GDV: £5,000,000

- Development Costs: £3,500,000

- Developer’s Profit: £1,000,000

Residual Land Value = £5,000,000 – £3,500,000 – £1,000,000 = £500,000

The developer can afford to pay a maximum of £500,000 for the land. If the land costs more, the project becomes unviable.

Why is Residual Land Valuation Important?

- Informed Decision-Making: RLV helps developers understand whether a site is financially feasible.

- Negotiating Power: By knowing the maximum price you can pay for the land, you’re in a stronger position to negotiate.

- Project Viability: Ensures that development projects meet profitability thresholds.

- Strategic Planning: Allows developers to compare multiple sites and choose the one with the best return on investment.

Challenges of Residual Land Valuation

While the concept is simple, RLV calculations rely heavily on accurate inputs. Overestimating the GDV or underestimating development costs can lead to flawed valuations. Factors such as fluctuating market conditions, unexpected construction issues, and planning constraints can also impact profitability.

This is where technology comes in. Platforms like Viability streamline residual land valuations by automating calculations and incorporating up-to-date market data, ensuring accurate and reliable results.

How Viability Can Help

At Viability, we understand the complexities of site viability assessments. Our platform automates residual land valuations, integrating real-time data on construction costs, planning policies, and market values to give you instant, accurate results. By using Viability, developers can appraise more sites in less time, de-risk their decisions, and focus on delivering profitable projects. Read more on our Features page.

Whether you’re a small developer or managing multiple sites, our tools empower you to make informed, data-driven decisions.

Conclusion

Residual Land Valuation is an essential tool for anyone involved in property development. By understanding how to calculate and apply RLV, you can identify profitable opportunities, avoid costly mistakes, and negotiate smarter deals. Platforms like Viability make this process even more efficient, giving you the insights you need to succeed in a competitive market.